Tax Day 2019: Time to end taxes to confront inequality and implement an ecosocialist Green New Deal | Howie Hawkins for our Future

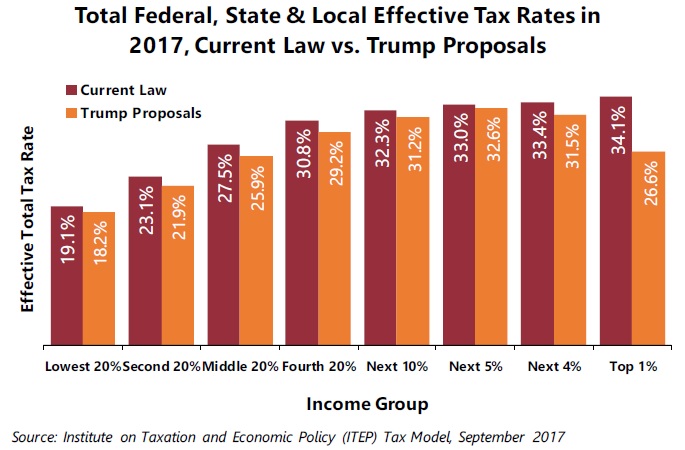

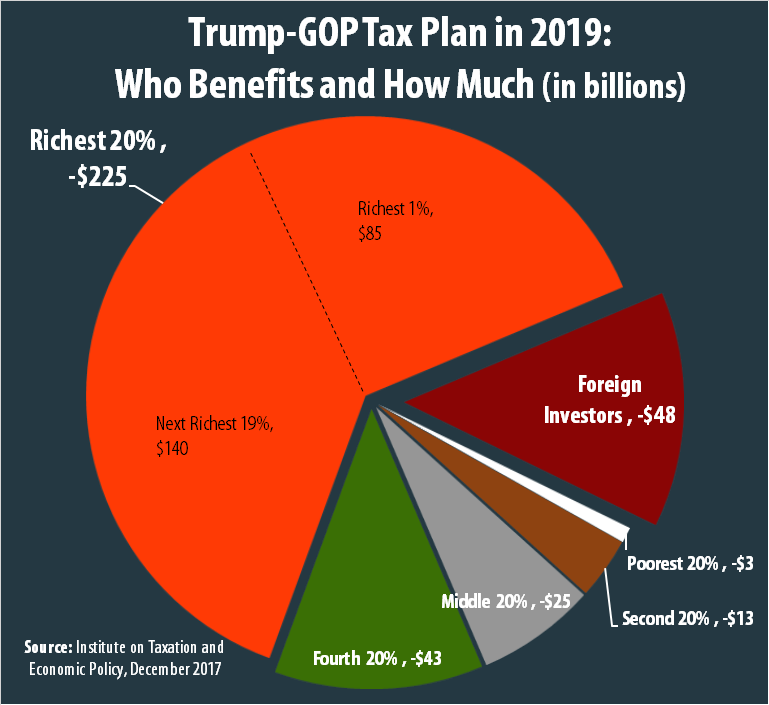

New Analysis Shows White House Tax Proposal Would be an Unprecedented Upward Redistribution of Wealth – ITEP

.png)