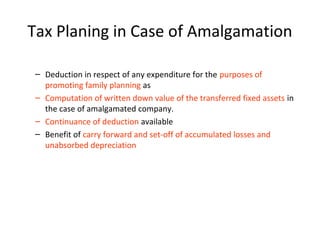

Amazon.com: TAX PLANNING: Relating to Amalgamation and Merger of Companies eBook : PARIHAR, ANURAG SINGH: Kindle Store

![PDF] Measuring Internal And External Corporate Governance Mechanisms On Companies Tax Planning : Evidence From Shariah-Compliant Companies In Malaysia | Semantic Scholar PDF] Measuring Internal And External Corporate Governance Mechanisms On Companies Tax Planning : Evidence From Shariah-Compliant Companies In Malaysia | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/faa4be5bf6e3e66140101a5879c7fe8096cfff1a/10-Table1-1.png)

PDF] Measuring Internal And External Corporate Governance Mechanisms On Companies Tax Planning : Evidence From Shariah-Compliant Companies In Malaysia | Semantic Scholar

Amazon.com: Rayney's Tax Planning for Family and Owner-Managed Companies 2020/21: 9781526514745: Rayney, Peter: Books

Putting It Through the Company: Tax Planning for Companies & Their Owners by Carl Bayley, Nick Braun, Paperback | Barnes & Noble®

![PDF] Money moves : Tax planning in multinational companies : a case of Microsoft | Semantic Scholar PDF] Money moves : Tax planning in multinational companies : a case of Microsoft | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/c84b075cc8fbd4ce036d72248355d7170fce64fc/34-Figure4.2-1.png)