CSOP Launched World's First Hang Seng TECH Index ETF, Performing Well for First 3 Days Since Launch | Wealthking Investments Limited

Csop Hang Seng Tech Index Fund Forecast: down to $1.086? - 3033 Fund Price Prediction, Long-Term & Short-Term Prognosis with Smart Technical Analysis

Hsbc Hang Seng Tech Fund Forecast: up to $0.137! - HSTC Fund Price Prediction, Long-Term & Short-Term Prognosis with Smart Technical Analysis

Lion-ocbc Securities Hang Seng Tech Etf Sgd Fund Forecast: down to $0.213? - LIHS Fund Price Prediction, Long-Term & Short-Term Prognosis with Smart Technical Analysis

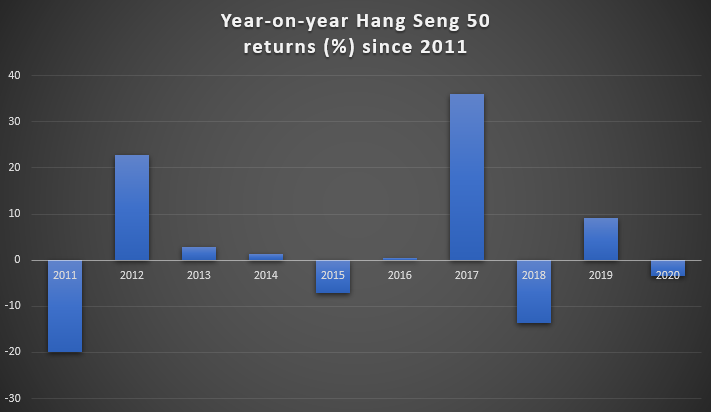

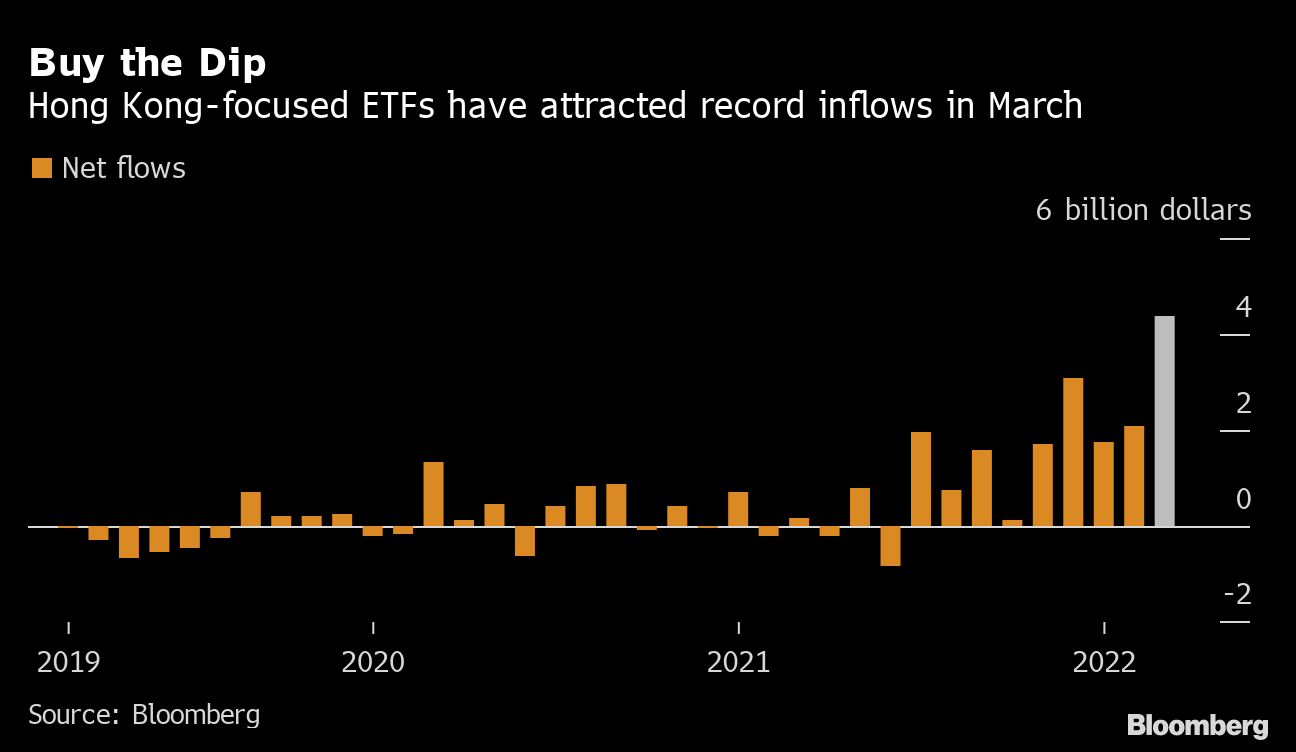

Hang Seng Index Vs Hang Seng TECH Index Vs Hang Seng ESG 50 Index: Which Has Been The Best (Worse) Performing ETF In 2022?

Mirae Asset Tiger China Hang Seng Tech Fund Forecast: down to $3003.190? - 371160 Fund Price Prediction, Long-Term & Short-Term Prognosis with Smart Technical Analysis

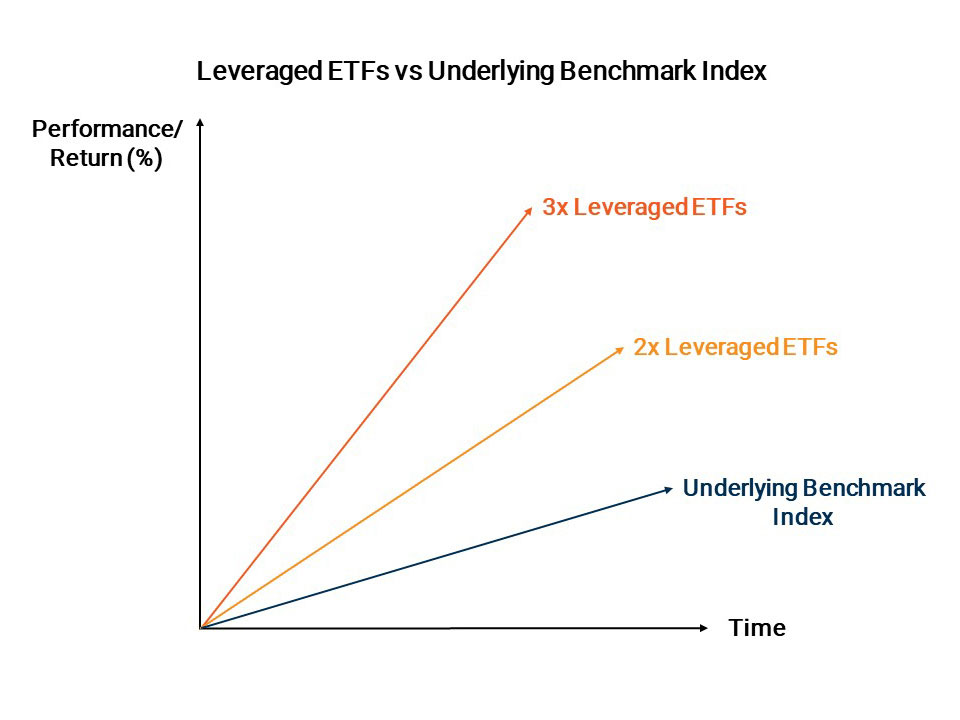

ETFGI reports Leveraged and Inverse ETFs and ETPs gathered net inflows of US$1.3 billion during November 2021 | ETFGI LLP